Renters Insurance in and around Newark

Welcome, home & apartment renters of Newark!

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented space or apartment, renters insurance can be a good idea to protect your valuables, including your fishing rods, tools, entertainment center, linens, and more.

Welcome, home & apartment renters of Newark!

Your belongings say p-lease and thank you to renters insurance

Safeguard Your Personal Assets

When renting makes the most sense for you, State Farm can help cover what you do own. State Farm agent Rolando Suarez can help you identify the right coverage for when the unexpected, like a fire or a water leak, affects your personal belongings.

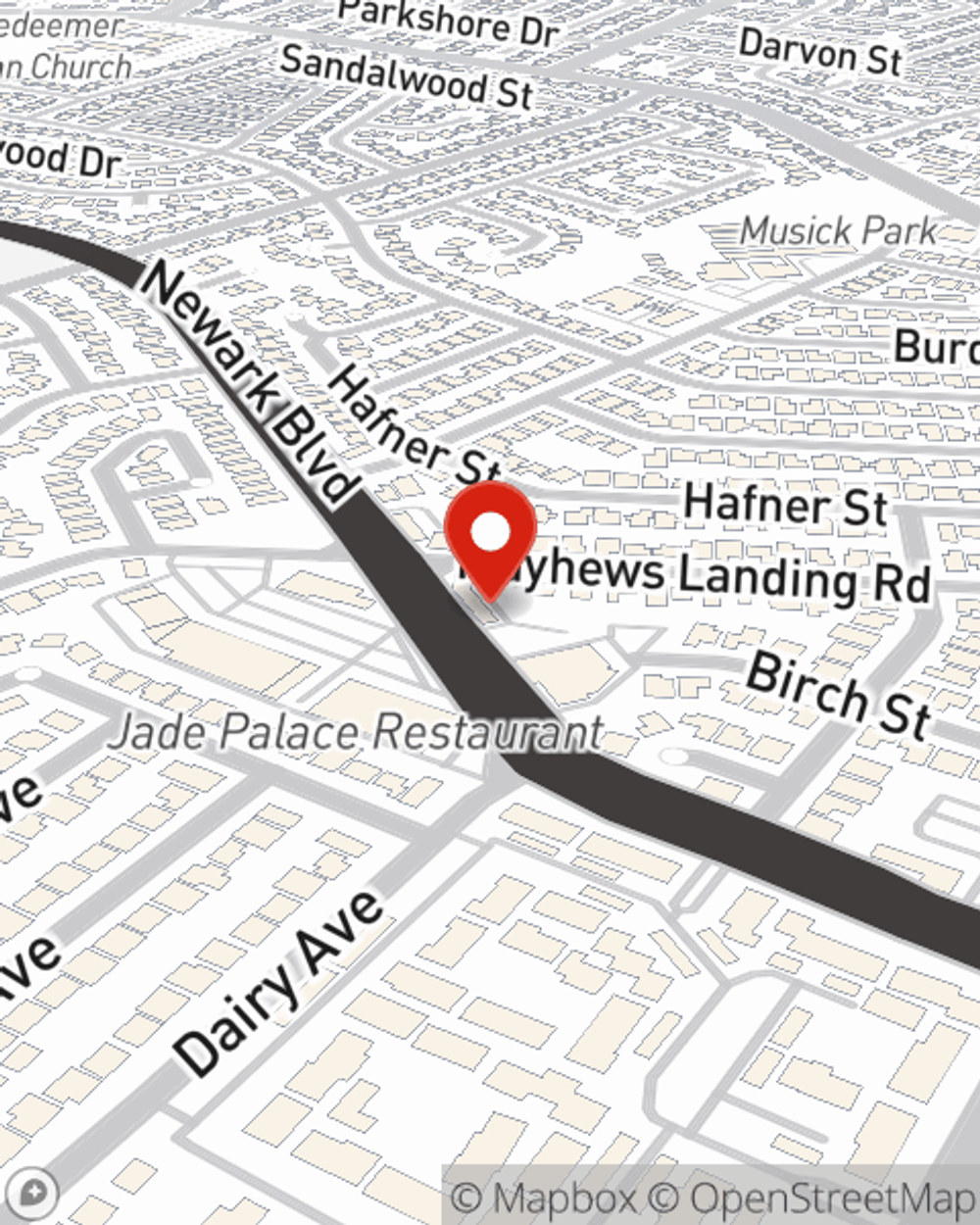

More renters choose State Farm® for their renters insurance over any other insurer. Newark renters, are you ready to learn how you can protect your belongings with renters insurance? Reach out to State Farm Agent Rolando Suarez today to see what State Farm can do for you.

Have More Questions About Renters Insurance?

Call Rolando at (510) 793-3168 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Rolando Suarez

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.